" Diabolical Money"

the Ancient Barter

was a moral, impartial and functional commercial system widely used by merchants and citizens,

but by its implicit nature the success of the Barter was conditioned by the mutual interest of the actors

in the goods offered, and this was an objective limit especially for the daily barters of the citizenship...

... and that worked great

until the nations "Minted Precious Coins" whose single value was determined by the material that constituted them and effigies, numbers or writings printed on them were used only to establish their origin and to confer an authoritative decorative effect ...

...in this way

each state could mint a maximum quantity of coins equivalent to its real physical availability

of the material, and if this was not enough it was purchased from other states offering goods

of various kinds in exchange. .

the golden system was virtuous but costly,

created logistical and safety problems,

but it did not create debit between the nations

and even the citizens did not create it

as they had the right to carry out independent foreign trade exchanges with their own valuable currencies in all those states that adopted similar monetary systems

(in gold, silver or other precious materials).

so, the productive activities and the commercial exchanges thickened and many nations lived a long period of prosperity,

but then .........

...but then PATATRAC came !

powerful financial coteries dissatisfied of their power began to spread among the nations

their Monetary Paralogisms by proposing complex and miraculous alternative solutions.....

...which asserted themselves,

thus creatinga trading system with Nominal Currency whose single value is determined by the numerical value imprinted on it which instead has a real insignificant intrinsic value .......

...initially

many nations were enthusiastic about the " Nominal Monetary System "

as it allowed them to " Print Money " at a very low cost for national trade.......

...but for foreign trade

the various governments "They had to submit" to the international supervisory regulations which correctly imposed on all banking institutions to communicate daily the exchange of national money in foreign currency to the New World Financial Organization, the body responsible for controlling the foreign debt granted to each nation in way directly proportional to their commercial importance,

precisely called GDP, gross domestic product ...

... in a similar way

when a nation reached its maximum foreign exchange exposure threshold

she was forced to issue Government Bonds agreeing on interests

and loan maturities ...

... this method

allowed public bodies, entrepreneurs and private citizens of the aforementioned

nationto continue to purchase goods and services from foreign countries joining the

" New Nominal Monetary System " ...

... and so far

the modern pecuniary formula would seem fair and idyllic .....

... but in harmonic consonance,

the more the foreign debt of the nations increased, the more the distrust of potential buyers of state bonds grew, who began to speculate asking for ever higher interest rates and ever shorter maturities, in short, a viscous web in which multiple states got entangled " Creating Excessive Debts " connected to unfair passive interests that threatened default!

from the " Labyrinthine Vestal Pecuniary "

the pitfalls of the modern financial formula emerge ...

... however by magic, here is again Powerful Coteries,

that through its intrepid Angels-Paladins proposed new quirky solutions

of " Creative Monetary Finance " to save many states from probable default ...

... and so it was

the states also accepted the " Creative Monetary Finance " ,

which has propagated in the troubled nations an effective temporary well-being ...

...exactly, a temporary well-being, because

the unsustainability of Sophisticated Creative Monetary Finance caused numerous commercial failures on which the "Intrepid Angels-Paladins" of the "Powerful Coteries" promptly rushed for buy "Goods and Activities of Value" at bargain prices.....

... nevertheless,

the spiraling spiral of foreign debt continued to crush many nations ....

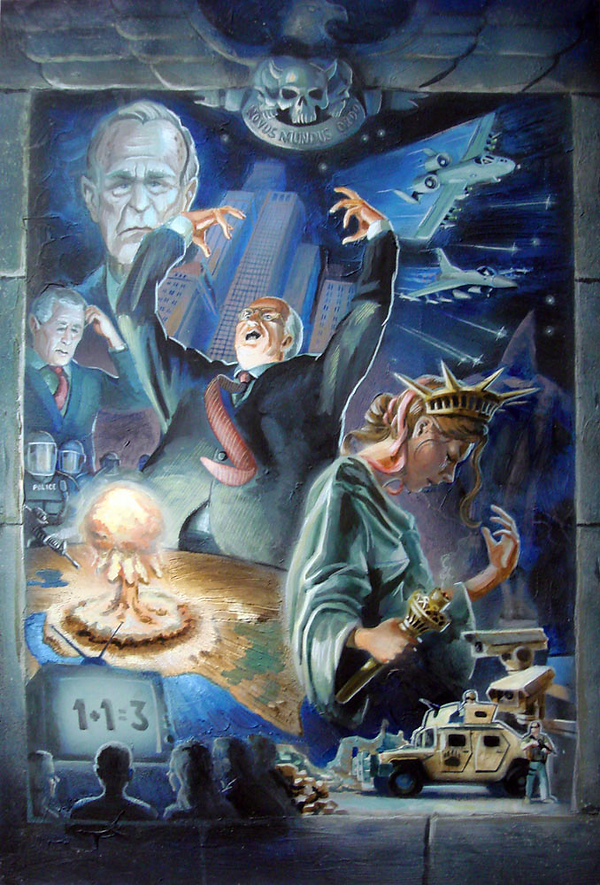

... the pitfalls of " Modern Nominal Monetary System "

have come true in a global concert orchestrated by the "Powerful Coteries" which, behind the scenes, they dominate the international financial scenario, also influencing factually the political one with the ultimate aim of satisfying their insatiable thirst for power and control of the masses .....

" Historical Aphorisms "

The End

... and here comes the brilliant idea of "FINE GOLD COINS"

idea then spread and adopted by various peoples who were able to intensify and optimize exchanges

mercantile also simplifying the daily ones of its citizens.